Mario Draghi: Unemployment in the euro area

Autor: Bancherul.ro

Autor: Bancherul.ro

2014-08-23 11:15

Unemployment in the euro area

Speech by Mario Draghi, President of the ECB,

Annual central bank symposium in Jackson Hole,

22 August 2014:

No one in society remains untouched by a situation of high unemployment. For the unemployed themselves, it is often a tragedy which has lasting effects on their lifetime income. For those in work, it raises job insecurity and undermines social cohesion. For governments, it weighs on public finances and harms election prospects. And unemployment is at the heart of the macro dynamics that shape short- and medium-term inflation, meaning it also affects central banks. Indeed, even when there are no risks to price stability, but unemployment is high and social cohesion at threat, pressure on the central bank to respond invariably increases.

1. The causes of unemployment in the euro area

The key issue, however, is how much we can really sustainably affect unemployment, which in turn is a question – as has been much discussed at this conference – of whether the drivers are predominantly cyclical or structural. As we are an 18 country monetary union this is necessarily a complex question in the euro area, but let me nonetheless give a brief overview of how the ECB currently assesses the situation.

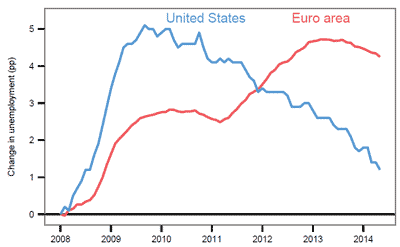

Figure 1: Change in the unemployment rate since 2008 – the euro area and the US

The long recession in the euro area

The first point to make is that the euro area has suffered a large and particularly sustained negative shock to GDP, with serious consequences for employment. This is visible in Figure 1, which shows the evolution of unemployment in the euro area and the US since 2008. Whereas the US experienced a sharp and immediate rise in unemployment in the aftermath of the Great Recession, the euro area has endured two rises in unemployment associated with two sequential recessions.

From the start of 2008 to early 2011 the picture in both regions is similar: unemployment rates increase steeply, level off and then begin to gradually fall. This reflects the common sources of the shock: the synchronisation of the financial cycle across advanced economies, the contraction in global trade following the Lehman failure, coupled with a strong correction of asset prices – notably houses – in certain jurisdictions.

From 2011 onwards, however, developments in the two regions diverge. Unemployment in the US continues to fall at more or less the same rate. [1] In the euro area, on the other hand, it begins a second rise that does not peak until April 2013. This divergence reflects a second, euro area-specific shock emanating from the sovereign debt crisis, which resulted in a six quarter recession for the euro area economy. Unlike the post-Lehman shock, however, which affected all euro area economies, virtually all of the job losses observed in this second period were concentrated in countries that were adversely affected by government bond market tensions (Figure 2).

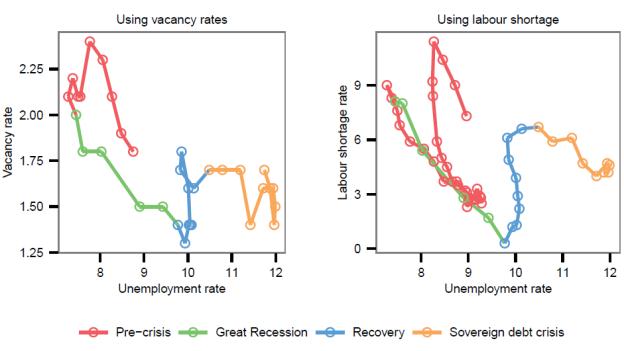

Figure 2: Relationship between financial stress and unemployment

The sovereign debt crisis operated through various channels, but one of its most important effects was to disable in part the tools of macroeconomic stabilisation.

On the fiscal side, non-market services – including public administration, education and healthcare – had contributed positively to employment in virtually all countries during the first phase of the crisis, thus somewhat cushioning the shock. In the second phase, however, fiscal policy was constrained by concerns over debt sustainability and the lack of a common backstop, especially as discussions related to sovereign debt restructuring began. The necessary fiscal consolidation had to be frontloaded to restore investor confidence, creating a fiscal drag and a downturn in public sector employment which added to the ongoing contraction in employment in other sectors.

Sovereign pressures also interrupted the homogenous transmission of monetary policy across the euro area. Despite very low policy rates, the cost of capital actually rose in stressed countries in this period, meaning monetary and fiscal policy effectively tightened in tandem. Hence, an important focus of our monetary policy in this period was – and still is – to repair the monetary transmission mechanism. Establishing a precise link between these impairments and unemployment performance is not straightforward. However, ECB staff estimates of the “credit gap” for stressed countries – the difference between the actual and normal volumes of credit in the absence of crisis effects – suggest that that credit supply conditions are exerting a significant drag on economic activity. [2]

Cyclical and structural factors

Cyclical factors have therefore certainly contributed to the rise in unemployment. And the economic situation in the euro area suggests they are still playing a role. The most recent GDP data confirm that the recovery in the euro area remains uniformly weak, with subdued wage growth even in non-stressed countries suggesting lacklustre demand. In these circumstances, it seems likely that uncertainty over the strength of the recovery is weighing on business investment and slowing the rate at which workers are being rehired.

That being said, there are signs that, in some countries at least, a significant share of unemployment is also structural.

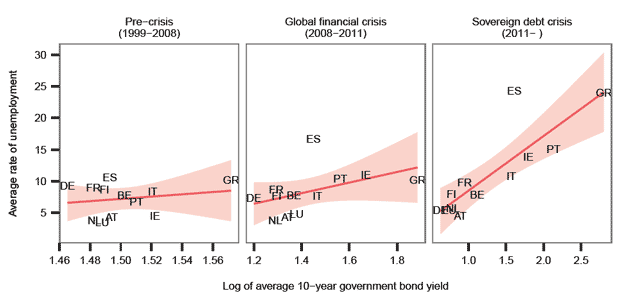

For example, the euro area Beveridge curve – which summarises unemployment developments at a given level of labour demand (or vacancies) – suggests the emergence of a structural mismatch across euro area labour markets (Figure 3). In the first phase of the crisis strong declines in labour demand resulted in a steep rise in euro area unemployment, with a movement down along the Beveridge curve. The second recessionary episode, however, led to a further strong increase in the unemployment rate even though aggregate vacancy rates showed marked signs of improvement. This may imply a more permanent outward shift.

Figure 3: Evolution of the euro area Beveridge curve over the crisis

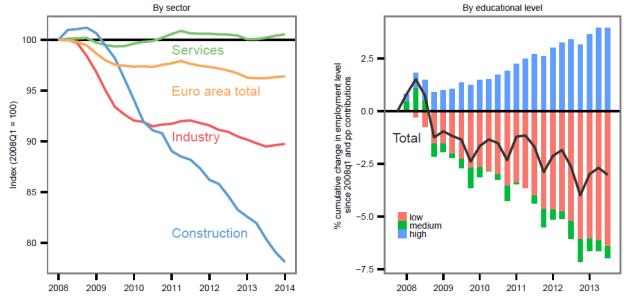

Part of the explanation for the movement of the Beveridge curve seems to be the sheer magnitude of the job destruction in some countries, which has led to reduced job-finding rates, extended durations of unemployment spells and a higher share of long-term unemployment. This reflects, in particular, the strong sectoral downsizing of the previously overblown construction sector (Figure 4), which, consistent with experience in the US, tends to lower match efficiency. [3] By the end of 2013, the stock of long-term unemployed (those unemployed for a year or more) accounted for over 6% of the total euro area labour force – more than double the pre-crisis level.

Figure 4: Evolution of euro area employment by sector and educational level

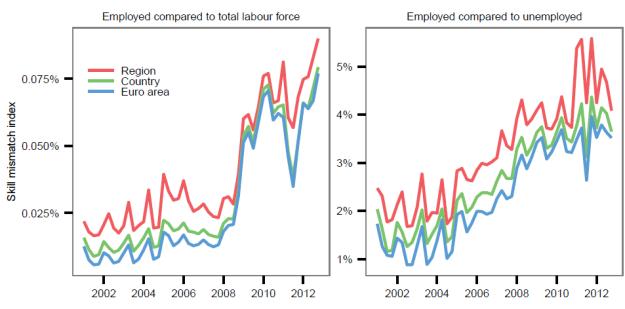

Another important explanation seems to be a lack of redeployment opportunities for displaced low-skilled workers, as evidenced by the growing disparity between the skills of the labour force and the skills required by employers. Analysis of the evolution of skill mismatch [4] suggests a notable increase in mismatch at regional, country and euro area level (Figure 5). As the previous figure shows, employment losses in the euro area are strongly concentrated among low skilled workers

Figure 5: Skill mismatch indices for the euro area

All in all, estimates provided by international organisations – in particular, the European Commission, the OECD and the IMF – suggest that the crisis has resulted in an increase in structural unemployment across the euro area, rising from an average (across the three institutions) of 8.8% in 2008 to 10.3% by 2013. [5]

Nuancing the picture

There are nevertheless two important qualifications to make here.

The first is that estimates of structural unemployment are surrounded by considerable uncertainty, in particular in real time. For example, research by the European Commission suggests that estimates of the Non-Accelerating Wage Rate of Unemployment (NAWRU) in the current situation are likely to overstate the magnitude of unemployment linked to structural factors, notably in the countries most severely hit by the crisis. [6]

The second qualification is that behind the aggregate data lies a very heterogeneous picture. The current unemployment rate in the euro area of 11.5% is the (weighted) average of unemployment rates close to 5% in Germany and 25% in Spain. Structural developments also differ: analysis of the Beveridge curve at the country level reveals, for example, a pronounced inward shift in Germany, whereas in France, Italy and in particular Spain, the curves move outward.

This heterogeneity reflects different initial conditions, such as varying sectoral compositions of employment (in particular the share employed in construction), as well as the fact that unemployment rates have historically been persistently higher in some euro area countries than others. [7] But it also reflects the relationship between labour market institutions and the impact of shocks on employment. [8] The economies that have weathered the crisis best in terms of employment tend also to be those with more flexibility in the labour market to adjust to economic conditions.

In Germany, for example, the inward shift in the Beveridge curve seen over the course of the crisis follows a trend that began in the mid-2000s after the introduction of the Hartz labour market reforms. Its relatively stronger employment performance was also linked to the fact that German firms had instruments available to reduce employees’ working time at reasonable costs – i.e. the intensive margin – including reducing overtime hours, greater working time flexibility at the firm level, and extensive use of short-time work schemes. [9]

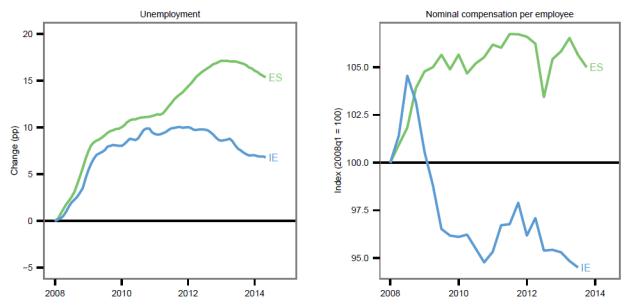

Even within the group of countries that experienced the sovereign debt crisis most acutely, we can see a differential impact of labour market institutions on employment. Ireland and Spain, for example, both experienced a large destruction of employment in the construction sector after the Lehman shock, but fared quite differently during the sovereign debt crisis. Unemployment in Ireland stabilised and then fell, whereas in Spain it increased until January 2013 (Figure 6). From 2011 to 2013 structural unemployment is estimated to have risen by around 0.5 percentages points in Ireland, whereas it increased by more than 2.5 percentages points in Spain. [10]

This diverging performance can in part be accounted for by emigration, especially of foreign-born labour [11], which was much higher in Ireland. But it also reflects the fact that Ireland entered the crisis with a relatively flexible labour market and adopted further labour market reforms under its EU-IMF programme beginning in November 2010. Spain, on the other hand, entered the crisis with strong labour market rigidities and reform only started meaningfully in 2012.

Importantly, until then, the capacity of firms to adjust to the new economic conditions was hampered in Spain by sectoral and regional collective bargaining agreements and wage indexation. Survey evidence indicates that Spain was among the countries where indexation was more frequent – covering about 70% of firms. [12] As a result, as Figure 6 shows, nominal compensation per employee continued to rise in Spain until the third quarter of 2011, despite a more than 12 percentage point increase in unemployment in that time. In Ireland, by contrast, downward wage adjustment began already in the fourth quarter of 2008 and proceeded more quickly.

The upshot was that, whereas the Irish labour market facilitated some adjustment through prices, the Spanish labour market adjusted primarily through quantities: firms were forced to reduce labour costs by reducing employment. And due to a high degree of duality in the Spanish labour market, this burden of adjustment was concentrated in particular on a less protected group – those on temporary contracts. These had been particularly prevalent in Spain in advance of the crisis, accounting for around one third of all employment contracts. [13]

In Spain, as in other stressed countries, a number of these labour market rigidities have since been addressed through structural reforms with positive effects. For example, the OECD estimates that the 2012 labour market reform in Spain has improved transitions out of unemployment and into employment at all unemployment durations. [14]

Figure 6: Unemployment and nominal compensation developments in Ireland and Spain

To sum up, unemployment in the euro area is characterised by relatively complex interactions. There have been differentiated demand shocks across countries. These shocks have interacted with initial conditions and national labour market institutions in different ways – and the interactions have changed as new reforms have been adopted. Consequently, estimates of the degree of cyclical and structural unemployment have to be made with quite some caution. But it is clear that such heterogeneity in labour market institutions is a source of fragility for the monetary union.

2. Responding to high unemployment

So what conclusions can we draw from this as policymakers? The only conclusion we can safely draw, in my view, is that we need action on both sides of the economy: aggregate demand policies have to be accompanied by national structural policies.

Demand side policies are not only justified by the significant cyclical component in unemployment. They are also relevant because, given prevailing uncertainty, they help insure against the risk that a weak economy is contributing to hysteresis effects. Indeed, while in normal conditions uncertainty would imply a higher degree of caution for fear of over-shooting, at present the situation is different. The risks of “doing too little” – i.e. that cyclical unemployment becomes structural – outweigh those of “doing too much” – that is, excessive upward wage and price pressures.

At the same time, such aggregate demand policies will ultimately not be effective without action in parallel on the supply side. Like all advanced economies, we are operating in a set of initial conditions determined by the last financial cycle, which include low inflation, low interest rates and a large debt overhang in the private and public sectors. In such circumstances, due to the zero lower bound constraint, there is a real risk that monetary policy loses some effectiveness in generating aggregate demand. The debt overhang also inevitably reduces fiscal space.

In this context, engineering a higher level and trend of potential growth – and thereby also government income – can help recover a margin for manoeuvre and allow both policies regain traction over the economic cycle. Reducing structural unemployment and raising labour participation is a key part of that. This is also particularly relevant for the euro area as, to list just one channel, higher unemployment in certain countries could lead to elevated loan losses, less resilient banks and hence a more fragmented transmission of monetary policy.

Boosting aggregate demand

On the demand side, monetary policy can and should play a central role, which currently means an accommodative monetary policy for an extended period of time. I am confident that the package of measures we announced in June will indeed provide the intended boost to demand, and we stand ready to adjust our policy stance further.

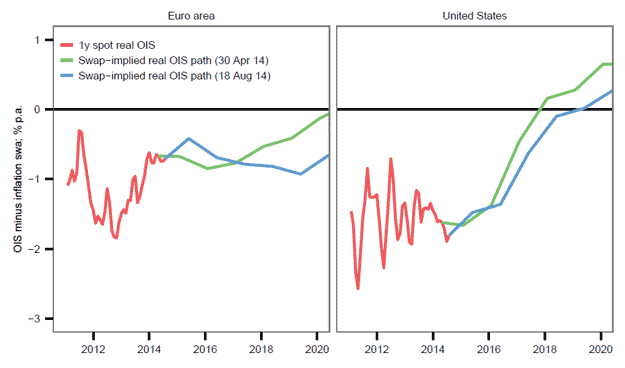

We have already seen exchange rate movements that should support both aggregate demand and inflation, which we expect to be sustained by the diverging expected paths of policy in the US and the euro area (Figure 7). We will launch our first Targeted Long-Term Refinancing Operation in September, which has so far garnered significant interest from banks. And our preparation for outright purchases in asset-backed security (ABS) markets is fast moving forward and we expect that it should contribute to further credit easing. Indeed, such outright purchases would meaningfully contribute to diversifying the channels for us to generate liquidity.

Figure 7: Expected real interest rate path in the euro area and the US

Inflation has been on a downward path from around 2.5% in the summer of 2012 to 0.4% most recently. Acknowledging this, the Governing Council would use also unconventional instruments to safeguard the firm anchoring of inflation expectations over the medium- to long -term.

Turning to fiscal policy, since 2010 the euro area has suffered from fiscal policy being less available and effective, especially compared with other large advanced economies. This is not so much a consequence of high initial debt ratios – public debt is in aggregate not higher in the euro area than in the US or Japan. It reflects the fact that the central bank in those countries could act and has acted as a backstop for government funding. This is an important reason why markets spared their fiscal authorities the loss of confidence that constrained many euro area governments’ market access. This has in turn allowed fiscal consolidation in the US and Japan to be more backloaded.

Thus, it would be helpful for the overall stance of policy if fiscal policy could play a greater role alongside monetary policy, and I believe there is scope for this, while taking into account our specific initial conditions and legal constraints. These initial conditions include levels of government expenditure and taxation in the euro area that are, in relation to GDP, already among the highest in the world. And we are operating within a set of fiscal rules – the Stability and Growth Pact – which acts as an anchor for confidence and that would be self-defeating to break.

Let me in this context emphasise four elements.

First, the existing flexibility within the rules could be used to better address the weak recovery and to make room for the cost of needed structural reforms.

Second, there is leeway to achieve a more growth-friendly composition of fiscal policies. As a start, it should be possible to lower the tax burden in a budget-neutral way. [15] This strategy could have positive effects even in the short-term if taxes are lowered in those areas where the short-term fiscal multiplier is higher, and expenditures cut in unproductive areas where the multiplier is lower. Research suggests positive second-round effects on business confidence and private investment could also be achieved in the short-term. [16]

Third, in parallel it may be useful to have a discussion on the overall fiscal stance of the euro area. Unlike in other major advanced economies, our fiscal stance is not based on a single budget voted for by a single parliament, but on the aggregation of eighteen national budgets and the EU budget. Stronger coordination among the different national fiscal stances should in principle allow us to achieve a more growth-friendly overall fiscal stance for the euro area.

Fourth, complementary action at the EU level would also seem to be necessary to ensure both an appropriate aggregate position and a large public investment programme – which is consistent with proposals by the incoming President of the European Commission. [17]

Reforming structural policies

No amount of fiscal or monetary accommodation, however, can compensate for the necessary structural reforms in the euro area. As I said, structural unemployment was already estimated to be very high coming into the crisis (around 9%). Indeed, some research suggests it has been high since the 1970s. [18] And given the interactions I described, there are important reasons why national structural reforms that tackle this problem can no longer be delayed.

This reform agenda spans labour markets, product markets and actions to improve the business environment. I will however focus here on labour markets, where there are two cross-cutting themes that I see as a priority.

The first is policies that allow workers to redeploy quickly to new job opportunities and hence lower unemployment duration. Such policies include enabling firm-level agreements that allow wages to better reflect local labour market conditions and productivity developments; allowing for greater wage differentiation across workers and between sectors; reductions in employment adjustment rigidities and especially labour market dualities; and product market reforms which help to speed up the reallocation of resources and employment to more productive sectors.

The second theme is raising the skill intensity of the workforce. We have already seen the disproportionate effect of the crisis on low skilled workers, which implies a period of re-skilling will be necessary to get people back into work. The longer-term effects of high youth unemployment also point to this conclusion. The number of unemployed aged between 15 and 24, relative to the labour force of the same age group, increased from an already high level of around 15% in 2007 to 24% in 2013. This has most likely left significant “scarring” as the young have lost access to a crucial step of on-the-job training.

The issue of skill intensity is also very relevant for potential growth. While raising labour participation is crucial, demographic prospects imply that it will provide a diminishing contribution to future potential. Lifting trend growth will have to come mainly through raising labour productivity. Thus, we need to ensure that, to the extent possible, employment is concentrated in high-value added, high-productivity sectors, which in turn is a function of skills.

What is more, in the global economy the euro area cannot compete on costs alone with emerging countries, if only because of our social model. Our comparative advantage therefore has to come from combining cost competitiveness with specialisation in high-value added activities – a business model that countries such as Germany have successfully demonstrated. Seen from this perspective, insufficient skill levels will effectively raise the non-accelerating inflation rate of unemployment (NAIRU) by causing more workers to drop out of the ‘competitiveness zone’ and become unemployable.

Raising skills is clearly first and foremost about education, where there is much that could still be done. The percentage of the working age population that has completed upper secondary or tertiary education in the euro area ranges from a high of more than 90% in some countries to a low of around 40% in others. But there is also an important role for active labour market policies, such as lifelong learning, and for eradicating distortions such labour market duality. The latter would, among other things, help reduce inefficient worker turnover and increase incentives for employers and employees to invest in developing job-specific skills.

3. Conclusion

Let me conclude.

Unemployment in the euro area is a complex phenomenon, but the solution is not overly complicated to understand. A coherent strategy to reduce unemployment has to involve both demand and supply side policies, at both the euro area and the national levels. And only if the strategy is truly coherent can it be successful.

Without higher aggregate demand, we risk higher structural unemployment, and governments that introduce structural reforms could end up running just to stand still. But without determined structural reforms, aggregate demand measures will quickly run out of steam and may ultimately become less effective. The way back to higher employment, in other words, is a policy mix that combines monetary, fiscal and structural measures at the union level and at the national level. This will allow each member of our union to achieve a sustainably high level of employment.

We should not forget that the stakes for our monetary union are high. It is not unusual to have regional disparities in unemployment within countries, but the euro area is not a formal political union and hence does not have permanent mechanisms to share risk, namely through fiscal transfers. [19] Cross-country migration flows are relatively small and are unlikely to ever become a key driver of labour market adjustment after large shocks. [20]

Thus, the long-term cohesion of the euro area depends on each country in the union achieving a sustainably high level of employment. And given the very high costs if the cohesion of the union is threatened, all countries should have an interest in achieving this.

[1]It is important to note, however, that the difference in euro area unemployment developments relative to the US also reflects very different developments in labour market participation. Over the period 2010-12, the decline in the participation rate contributed significantly to the fall in the unemployment rate in the US. At the same time, the rising participation rate in the euro area explains part of the rise in the unemployment rate. Assuming that, in both the US and the euro area, the labour force participation ratios had remained unchanged compared with 2007 and that the difference to the actual ratios had been fully reflected in the number of unemployed, the US unemployment rate in 2012 would have been higher than that of the euro area. For more information see Box 7 in the ECB Monthly Bulletin, August 2013.

[2]The “credit gap” is computed as the difference between the actual and the counterfactual path of the total credit to non-financial corporations simulated by using the multi-country BVAR of Altavilla et al. (2014). More precisely, the counterfactual path has been obtained by measuring the stock of loans consistent with pre-crisis past business cycle regularities in absence of financial friction for the banking system. For further details see Altavilla, Carlo, Domenico Giannone and Michele Lenza (2014). "The Financial and Macroeconomic Effects of the OMT Announcements," ECB Working Paper No.1707.

[3]U.S. industry-level studies find that a large part of the decline in match efficiency is driven by the low level of job openings and hires per vacancy in the construction sector—see e.g. Barnichon, Regis, Michael W. L. Elsby, Bart Hobijn and Ayșegül Șahin (2012) “Which Industries are Shifting the Beveridge Curve?" Monthly Labor Review, June 2012, 25-37; Davis, Steven J., R. Jason Faberman, and John C. Haltiwanger (2012) “Recruiting Intensity during and after the Great Recession: National and Industry Evidence,” American Economic Review: Papers and Proceedings.

[4]Based on skill mismatch indexes computed as the difference between skill demand (proxied by educational attainments of the employed) and skill supply (proxied by the educational attainments of the labour force or unemployed, respectively). See (forthcoming) ECB Occasional Paper entitled “Comparisons and contrasts of the impact of the crisis on euro area labour markets’’.

[5]In terms of calculating structural unemployment, the European Commission estimates a NAWRU while OECD estimates the NAIRU using a filter technique that seeks to disentangle movements in the unemployment rates into a structural and a cyclical component, on the basis of a Phillips-curve relationship. The estimates by the IMF are not based on any “official” method – meaning that they do not publish a model or a given methodology, since their internal estimates are subject to judgement.

[6]European Commission, “Labour Market Developments in Europe 2013”, European Economy 6/2013.

[7]In the short pre-crisis period between 1995 and 2007, for which we have homogeneous euro area data, average unemployment rates were around 9% in France and Italy, but above 14% in Spain. In Germany, the unemployment rate was also 9%, but only as a result of a large, previous increase following reunification.

[8]Blanchard, Olivier, and Justin Wolfers (1999), “The Role of Shocks and Institutions in the Rise of European Unemployment: the Aggregate Evidence”, NBER Working Paper 7282.

[9]See Burda, Michael C., and Jennifer Hunt (2011), “What Explains the German Labour Market Miracle in the Great Recession”, NBER Working Paper No. 17187; and Brenke, Karl, Ulf Rinne and Klaus F. Zimmermann (2013), “Short-time work: The German answer to the Great Recession”, International Labour Review Vol. 152, Issue 2.

[10]Average of European Commission, OECD and IMF estimates.

[11]While both Ireland and Spain experienced a strong influx of foreign-born labour in advance of the crisis, an important difference between the two counties is that in Spain a large proportion of these workers were naturalised. This in part accounts for the different emigration dynamics since the crisis.

[12]European Central Bank (2010), Wage Dynamics in Europe: Final Report of the Wage Dynamics Network (WDN), European Central Bank.

[13]See OECD Employment Outlook (2012), “How Does Spain Compare?”.

[14]OECD, “The 2012 Labour Market Reform in Spain: a Preliminary Assessment”, December 2013.

[15]The recommendations for the euro area adopted in the context of the 2014 European Semester explicitly call on the Eurogroup to explore ways to reduce the high tax wedge on labour.

[16] Alesina, Alberto, Carlo Favero and Francesco Giavazzi (2014), “The output effect of fiscal consolidation plans”, mimeo, May 2014.

[17]The incoming European Commission President, Jean-Claude Juncker, has proposed a €300 billion public-private investment programme to help incentivise private investment in the EU economy.

[18]Blanchard, Olivier, (2006), “European unemployment”, Economic Policy, pp. 5-59.

[19]Cross-country transfers between euro area countries exist as part of the EU cohesion policy. These funds are however in principle temporary, as they designed to support the “catching-up” process in lower income countries.

[20]Beyer, Robert C. M., and Frank Smets (2013), “Has mobility decreased? Reassessing regional labour market adjustments in Europe and the US”, mimeo, European Central Bank.

Comentarii

Adauga un comentariu

Adauga un comentariu folosind contul de Facebook

Alte stiri din categoria: Opinie

Cardurile devin inutile: acum se pot face plati instant gratis din aplicatiile bancare

Cardurile isi pierd treptat utilitatea, odata cu avansul noilor tehnologii pentru plati. Bancile romanesti au inceput sa implementeze platile instant din aplicatiile bancare, prin serviciul RoPay. Platile instant (care se fac in cateva secunde, la orice detalii

Au neglijat bancile securitatea pentru digitalizare?

Explozia fraudelor online poate fi considerata normala in conditiile dezvoltarii pe masura a digitalizarii si serviciilor bancare online. Dar ceea ce-mi da de gandit este usurinta cu care escrocii pot accesa o aplicatie bancara, pot face transferuri catre detalii

BRD isi lichideaza filialele din Romania. Va fi vanduta si banca?

BRD a cedat Bancii Transilvania firma de pensii private, BRD Pensii, iar compania de credite de consum, BRD Finance, este si ea in negocieri de vanzare, ceea ce alimenteaza zvonurile aparute la inceputul anului ca banca franceza are de gand sa-si vanda si banca din Romania. Mai ales ca detalii

De ce permit bancile transferuri catre platforme de criptomonede prin care se fac fraude online?

Bancile nu ar trebui sa transfere clientilor intreaga responsabilitate pentru fraudele online, ci sa-si asume o parte din vina, mai ales daca permit transferuri catre platforme de criptomonede (site-uri, aplicatii. portofele electronice) cunoscute ca fiind fraude sau care sunt detalii

- Banca Transilvania implineste 30 de ani

- De cand si cat de mult ar putea sa scada dobanzile in 2024?

- Ce responsabilitate au bancile in cazul fraudelor online?

- Creditele ipotecare ar putea creste in 2024, estimeaza Banca Transilvania

- Rambursarea ratelor la credite in Romania se face ca in celelalte tari din Europa; motoda propusa de ANPC este contrara interesului consumatorilor

- De ce ar majora bancile comisioanele pentru cash, daca se limiteaza cash-ul?

- Simona Halep, sustinuta in continuare de Banca Transilvania

- Romanii au incredere in banci ca le pot rezolva problemele, arata un sondaj

- Bancile sunt suspectate ca blocheaza accesul unor clienti la credite, prin scorul FICO al Biroului de Credit

- Doar 21% dintre romani au probleme cu băncile și IFN-urile, arata un sondaj CSALB

Criza COVID-19

- In majoritatea unitatilor BRD se poate intra fara certificat verde

- La BCR se poate intra fara certificat verde

- Firmele, obligate sa dea zile libere parintilor care stau cu copiii in timpul pandemiei de coronavirus

- CEC Bank: accesul in banca se face fara certificat verde

- Cum se amana ratele la creditele Garanti BBVA

Topuri Banci

- Topul bancilor dupa active si cota de piata in perioada 2022-2015

- Topul bancilor cu cele mai mici dobanzi la creditele de nevoi personale

- Topul bancilor la active in 2019

- Topul celor mai mari banci din Romania dupa valoarea activelor in 2018

- Topul bancilor dupa active in 2017

Asociatia Romana a Bancilor (ARB)

- Băncile din România nu au majorat comisioanele aferente operațiunilor în numerar

- Concurs de educatie financiara pentru elevi, cu premii in bani

- Creditele acordate de banci au crescut cu 14% in 2022

- Romanii stiu educatie financiara de nota 7

- Gradul de incluziune financiara in Romania a ajuns la aproape 70%

ROBOR

- ROBOR: ce este, cum se calculeaza, ce il influenteaza, explicat de Asociatia Pietelor Financiare

- ROBOR a scazut la 1,59%, dupa ce BNR a redus dobanda la 1,25%

- Dobanzile variabile la creditele noi in lei nu scad, pentru ca IRCC ramane aproape neschimbat, la 2,4%, desi ROBOR s-a micsorat cu un punct, la 2,2%

- IRCC, indicele de dobanda pentru creditele in lei ale persoanelor fizice, a scazut la 1,75%, dar nu va avea efecte imediate pe piata creditarii

- Istoricul ROBOR la 3 luni, in perioada 01.08.1995 - 31.12.2019

Taxa bancara

- Normele metodologice pentru aplicarea taxei bancare, publicate de Ministerul Finantelor

- Noul ROBOR se va aplica automat la creditele noi si prin refinantare la cele in derulare

- Taxa bancara ar putea fi redusa de la 1,2% la 0,4% la bancile mari si 0,2% la cele mici, insa bancherii avertizeaza ca indiferent de nivelul acesteia, intermedierea financiara va scadea iar dobanzile vor creste

- Raiffeisen anunta ca activitatea bancii a incetinit substantial din cauza taxei bancare; strategia va fi reevaluata, nu vor mai fi acordate credite cu dobanzi mici

- Tariceanu anunta un acord de principiu privind taxa bancara: ROBOR-ul ar putea fi inlocuit cu marja de dobanda a bancilor

Statistici BNR

- Deficitul contului curent, aproape 18 miliarde euro după primele opt luni

- Deficitul contului curent, peste 9 miliarde euro pe primele cinci luni

- Deficitul contului curent, 6,6 miliarde euro după prima treime a anului

- Deficitul contului curent pe T1, aproape 4 miliarde euro

- Deficitul contului curent după primele două luni, mai mare cu 25%

Legislatie

- Legea nr. 311/2015 privind schemele de garantare a depozitelor şi Fondul de garantare a depozitelor bancare

- Rambursarea anticipata a unui credit, conform OUG 50/2010

- OUG nr.21 din 1992 privind protectia consumatorului, actualizata

- Legea nr. 190 din 1999 privind creditul ipotecar pentru investiții imobiliare

- Reguli privind stabilirea ratelor de referinţă ROBID şi ROBOR

Lege plafonare dobanzi credite

- BNR propune Parlamentului plafonarea dobanzilor la creditele bancilor intre 1,5 si 4 ori peste DAE medie, in functie de tipul creditului; in cazul IFN-urilor, plafonarea dobanzilor nu se justifica

- Legile privind plafonarea dobanzilor la credite si a datoriilor preluate de firmele de recuperare se discuta in Parlament (actualizat)

- Legea privind plafonarea dobanzilor la credite nu a fost inclusa pe ordinea de zi a comisiilor din Camera Deputatilor

- Senatorul Zamfir, despre plafonarea dobanzilor la credite: numai bou-i consecvent!

- Parlamentul dezbate marti legile de plafonare a dobanzilor la credite si a datoriilor cesionate de banci firmelor de recuperare (actualizat)

Anunturi banci

- Cate reclamatii primeste Intesa Sanpaolo Bank si cum le gestioneaza

- Platile instant, posibile la 13 banci

- Aplicatia CEC app va functiona doar pe telefoane cu Android minim 8 sau iOS minim 12

- Bancile comunica automat cu ANAF situatia popririlor

- BRD bate recordul la credite de consum, in ciuda dobanzilor mari, si obtine un profit ridicat

Analize economice

- România, pe locul 16 din 27 de state membre ca pondere a datoriei publice în PIB

- România, tot prima în UE la inflația anuală, dar decalajul s-a redus

- Exporturile lunare în august, la cel mai redus nivel din ultimul an

- Inflația anuală a scăzut la 4,62%

- Comerțul cu amănuntul, +7,3% cumulat pe primele 8 luni

Ministerul Finantelor

- Datoria publică, 51,4% din PIB la mijlocul anului

- Deficit bugetar de 3,6% din PIB după prima jumătate a anului

- Deficit bugetar de 3,4% din PIB după primele cinci luni ale anului

- Deficit bugetar îngrijorător după prima treime a anului

- Deficitul bugetar, -2,06% din PIB pe primul trimestru al anului

Biroul de Credit

- FUNDAMENTAREA LEGALITATII PRELUCRARII DATELOR PERSONALE IN SISTEMUL BIROULUI DE CREDIT

- BCR: prelucrarea datelor personale la Biroul de Credit

- Care banci si IFN-uri raporteaza clientii la Biroul de Credit

- Ce trebuie sa stim despre Biroul de Credit

- Care este procedura BCR de raportare a clientilor la Biroul de Credit

Procese

- ANPC pierde un proces cu Intesa si ARB privind modul de calcul al ratelor la credite

- Un client Credius obtine in justitie anularea creditului, din cauza dobanzii prea mari

- Hotararea judecatoriei prin care Aedificium, fosta Raiffeisen Banca pentru Locuinte, si statul sunt obligati sa achite unui client prima de stat

- Decizia Curtii de Apel Bucuresti in procesul dintre Raiffeisen Banca pentru Locuinte si Curtea de Conturi

- Vodafone, obligata de judecatori sa despagubeasca un abonat caruia a refuzat sa-i repare un telefon stricat sau sa-i dea banii inapoi (decizia instantei)

Stiri economice

- Datoria publică, 52,7% din PIB la finele lunii august 2024

- -5,44% din PIB, deficit bugetar înaintea ultimului trimestru din 2024

- Prețurile industriale - scădere în august dar indicele anual a continuat să crească

- România, pe locul 4 în UE la scăderea prețurilor agricole

- Industria prelucrătoare, evoluție neconvingătoare pe luna iulie 2024

Statistici

- România, pe locul trei în UE la creșterea costului muncii în T2 2024

- Cheltuielile cu pensiile - România, pe locul 19 în UE ca pondere în PIB

- Dobanda din Cehia a crescut cu 7 puncte intr-un singur an

- Care este valoarea salariului minim brut si net pe economie in 2024?

- Cat va fi salariul brut si net in Romania in 2024, 2025, 2026 si 2027, conform prognozei oficiale

FNGCIMM

- Programul IMM Invest continua si in 2021

- Garantiile de stat pentru credite acordate de FNGCIMM au crescut cu 185% in 2020

- Programul IMM invest se prelungeste pana in 30 iunie 2021

- Firmele pot obtine credite bancare garantate si subventionate de stat, pe baza facturilor (factoring), prin programul IMM Factor

- Programul IMM Leasing va fi operational in perioada urmatoare, anunta FNGCIMM

Calculator de credite

- ROBOR la 3 luni a scazut cu aproape un punct, dupa masurile luate de BNR; cu cat se reduce rata la credite?

- In ce mall din sectorul 4 pot face o simulare pentru o refinantare?

Noutati BCE

- Acord intre BCE si BNR pentru supravegherea bancilor

- Banca Centrala Europeana (BCE) explica de ce a majorat dobanda la 2%

- BCE creste dobanda la 2%, dupa ce inflatia a ajuns la 10%

- Dobânda pe termen lung a continuat să scadă in septembrie 2022. Ecartul față de Polonia și Cehia, redus semnificativ

- Rata dobanzii pe termen lung pentru Romania, in crestere la 2,96%

Noutati EBA

- Bancile romanesti detin cele mai multe titluri de stat din Europa

- Guidelines on legislative and non-legislative moratoria on loan repayments applied in the light of the COVID-19 crisis

- The EBA reactivates its Guidelines on legislative and non-legislative moratoria

- EBA publishes 2018 EU-wide stress test results

- EBA launches 2018 EU-wide transparency exercise

Noutati FGDB

- Banii din banci sunt garantati, anunta FGDB

- Depozitele bancare garantate de FGDB au crescut cu 13 miliarde lei

- Depozitele bancare garantate de FGDB reprezinta doua treimi din totalul depozitelor din bancile romanesti

- Peste 80% din depozitele bancare sunt garantate

- Depozitele bancare nu intra in campania electorala

CSALB

- La CSALB poti castiga un litigiu cu banca pe care l-ai pierde in instanta

- Negocierile dintre banci si clienti la CSALB, in crestere cu 30%

- Sondaj: dobanda fixa la credite, considerata mai buna decat cea variabila, desi este mai mare

- CSALB: Romanii cu credite caută soluții pentru reducerea ratelor. Cum raspund bancile

- O firma care a facut un schimb valutar gresit s-a inteles cu banca, prin intermediul CSALB

First Bank

- Ce trebuie sa faca cei care au asigurare la credit emisa de Euroins

- First Bank este reprezentanta Eurobank in Romania: ce se intampla cu creditele Bancpost?

- Clientii First Bank pot face plati prin Google Pay

- First Bank anunta rezultatele financiare din prima jumatate a anului 2021

- First Bank are o noua aplicatie de mobile banking

Noutati FMI

- FMI: criza COVID-19 se transforma in criza economica si financiara in 2020, suntem pregatiti cu 1 trilion (o mie de miliarde) de dolari, pentru a ajuta tarile in dificultate; prioritatea sunt ajutoarele financiare pentru familiile si firmele vulnerabile

- FMI cere BNR sa intareasca politica monetara iar Guvernului sa modifice legea pensiilor

- FMI: majorarea salariilor din sectorul public si legea pensiilor ar trebui reevaluate

- IMF statement of the 2018 Article IV Mission to Romania

- Jaewoo Lee, new IMF mission chief for Romania and Bulgaria

Noutati BERD

- Creditele neperformante (npl) - statistici BERD

- BERD este ingrijorata de investigatia autoritatilor din Republica Moldova la Victoria Bank, subsidiara Bancii Transilvania

- BERD dezvaluie cat a platit pe actiunile Piraeus Bank

- ING Bank si BERD finanteaza parcul logistic CTPark Bucharest

- EBRD hails Moldova banking breakthrough

Noutati Federal Reserve

- Federal Reserve anunta noi masuri extinse pentru combaterea crizei COVID-19, care produce pagube "imense" in Statele Unite si in lume

- Federal Reserve urca dobanda la 2,25%

- Federal Reserve decided to maintain the target range for the federal funds rate at 1-1/2 to 1-3/4 percent

- Federal Reserve majoreaza dobanda de referinta pentru dolar la 1,5% - 1,75%

- Federal Reserve issues FOMC statement

Noutati BEI

- BEI a redus cu 31% sprijinul acordat Romaniei in 2018

- Romania implements SME Initiative: EUR 580 m for Romanian businesses

- European Investment Bank (EIB) is lending EUR 20 million to Agricover Credit IFN

Mobile banking

- Comisioanele BRD pentru MyBRD Mobile, MyBRD Net, My BRD SMS

- Termeni si conditii contractuale ale serviciului You BRD

- Recomandari de securitate ale BRD pentru utilizatorii de internet/mobile banking

- CEC Bank - Ghid utilizare token sub forma de card bancar

- Cinci banci permit platile cu telefonul mobil prin Google Pay

Noutati Comisia Europeana

- Avertismentul Comitetului European pentru risc sistemic (CERS) privind vulnerabilitățile din sistemul financiar al Uniunii

- Cele mai mici preturi din Europa sunt in Romania

- State aid: Commission refers Romania to Court for failure to recover illegal aid worth up to €92 million

- Comisia Europeana publica raportul privind progresele inregistrate de Romania in cadrul mecanismului de cooperare si de verificare (MCV)

- Infringements: Commission refers Greece, Ireland and Romania to the Court of Justice for not implementing anti-money laundering rules

Noutati BVB

- BET AeRO, primul indice pentru piata AeRO, la BVB

- Laptaria cu Caimac s-a listat pe piata AeRO a BVB

- Banca Transilvania plateste un dividend brut pe actiune de 0,17 lei din profitul pe 2018

- Obligatiunile Bancii Transilvania se tranzactioneaza la Bursa de Valori Bucuresti

- Obligatiunile Good Pople SA (FRU21) au debutat pe piata AeRO

Institutul National de Statistica

- Producția industrială, în scădere semnificativă

- Pensia reală, în creștere cu 8,7% pe luna august 2024

- Avansul PIB pe T1 2024, majorat la +0,5%

- Industria prelucrătoare a trecut pe plus în aprilie 2024

- Deficitul comercial, în creștere de la o lună la alta

Informatii utile asigurari

- Data de la care FGA face plati pentru asigurarile RCA Euroins: 17 mai 2023

- Asigurarea împotriva dezastrelor, valabilă și in caz de faliment

- Asiguratii nu au nevoie de documente de confirmare a cutremurului

- Cum functioneaza o asigurare de viata Metropolitan pentru un credit la Banca Transilvania?

- Care sunt documente necesare pentru dosarul de dauna la Cardif?

ING Bank

- La ING se vor putea face plati instant din decembrie 2022

- Cum evitam tentativele de frauda online?

- Clientii ING Bank trebuie sa-si actualizeze aplicatia Home Bank pana in 20 martie

- Obligatiunile Rockcastle, cel mai mare proprietar de centre comerciale din Europa Centrala si de Est, intermediata de ING Bank

- ING Bank transforma departamentul de responsabilitate sociala intr-unul de sustenabilitate

Ultimele Comentarii

-

Bancnote vechi

Numar de ... detalii

-

Bancnote vechi

Am 3 bancnote vechi:1-1000000lei;1-5000lei;1-100000;mai multe bancnote cu eclipsa de ... detalii

-

Schimbare numar telefon Raiffeisen

Puteti schimba numarul de telefon la Raiffeisen din aplicatia Smart Mobile/Raiffeisen Online, ... detalii

-

Vreau sa schimb nr de telefon

Cum pot schimba nr.de telefon ... detalii

-

Eroare aplicație

Am avut ora și data din setările telefonului date pe manual și nu se deschidea BT Pay, în ... detalii