Banca Nationala a Romaniei (BNR) ar putea creste maine dobanda de politica monetara cu un sfert de punct, la 2,25%, pentru a stavili majorarea inflatiei, conform estimarilor analistilor.

Nu este exclus un avans mai important al dobanzii de referinta, de o jumatate de punct, la 2,50%, insa analistii cred ca BNR va continua tendinta conservatoare, in paralel cu urmarirea unui curs de schimb valutar stabil.

Analistii Erste Bank estimeaza ca BNR ar putea creste gradual dobanda pana la 3,50% la finalul lui 2022.

Cursul valutar euro/ron este estimat a creste intr-un ritm asemanator cu cel din 2021, de 1,3%, pana la 5,05 lei pentru un euro, la sfarsitul lui 2022.

"Spre deosebire de bancile centrale din regiune, se pare ca BNR nu vrea sa lupte cu inflatia in principal prin intarirea monedei nationale", spun analistii Erste Bank.

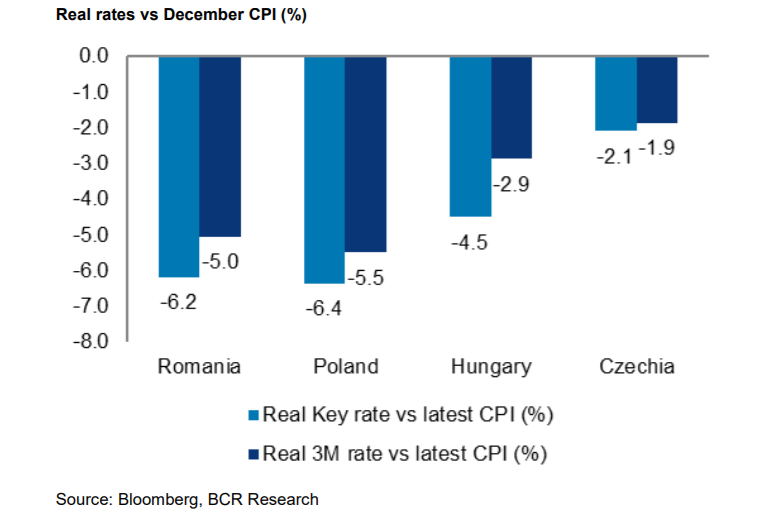

Inflatia anuala a avut o crestere cu 8,19% in decembrie 2021, in timp ce dobanda de referinta a BNR a ajuns la 2%, ceea ce inseamna o dobanda reala negativa, de 6,2%, apropiata de cea din Polonia (-6,4%), dar cu mult sub nivelurile din Ungaria (-4,5%) si Cehia (-2,1%), conform graficului Erste Bank (vezi foto).

Doves camp to prevail on weaker growth, stable RON

We see plenty of reasons for NBR to accelerate its rate hiking cycle and we suspect most NBR

watchers think alike. The NBR shrugged-off calls for catching-up speed with CEE central banks in

raising rates. Given NBR rhetoric, we expect it to remain on autopilot and deliver another 25bp key

rate hike to 2.25% at the next rate-setting meeting on 9 February, similar to Bloomberg survey

median. Further widening beyond ±100bp in standing facilities corridor seems unlikely. Hence,

without the alternative for additional tightening from a larger increase in the credit facility rate, we

see material risk (30%) for a 50bp key rate hike. The credit facility is the relevant operational

instrument under firm liquidity control management policy.

Provided that there is a consensus among NBR Board members to limit the standing facilities corridor at

±100bp, the hawks camp (two out of nine votes for 50bp at the last two rate-setting meetings instead of 25bp

favoured by the rest) could draw more adherents. On the other hand, money market indexes relevant for the

monetary policy transmission are significantly higher vs key rate level, though still well below vs most CEE

peers. The actions by regional central banks seemingly lost some importance recently in NBR decisionmaking. The repricing for Fed and ECB rates outlook, could weigh in, though some might argue for less

aggressive tightening to preserve ammunition for later, if needed to fend-off RON depreciation.

Implied yields are still offering some carry premium for the RON vs the CEE currencies. Supported by the

high costs of carry and by the general appreciation trend of CEE currency, the RON was remarkable stable

since the start of the year, likely without NBR support. Lack of RON weakening pressures means more

ammunition for the doves camp given the importance of the FX in NBR reaction function. Unlike peer central

banks, the NBR does not seem to favour fighting inflation by strengthening the domestic currency.

The new inflation forecast is likely to bring an upside revision in the headline CPI over the short-run and

persistently higher Core inflation for longer, with the inflation likely seen staying outside the NBR target band

over the entire policy horizon. High frequency data, though it improved towards the end of the fourth quarter

and it was subject to significant upside revisions (both industrial production and retail sales), came in weaker

vs the previous quarter, while economic confidence softened in January after a quite solid December.

The central bank appears to be comfortable with the fiscal consolidation plans with contained wage envelope

increase, amid some uncertainties. In spite of quite fast wage growth in the private sector and the prospects

of pay increase pressures, in real terms salaries are likely to be almost entirely offset by the inflation. All in

all, the NBR could expect contained inflationary pressures driven by the domestic demand in the coming

quarters.

We see further gradual rate hikes by the NBR this year, with the key rate at 3.00% by mid-2022 and reaching

3.50% by the year-end, assuming that the markets are correctly pricing Fed / ECB moves. We see

EUR/RON at 5.05 by the end-2022, with an average depreciation for the RON of 1.3% vs the single currency

this year, less than in 2021, with NBR more sensitive to it given the higher inflation.

Sursa: Erste Bank