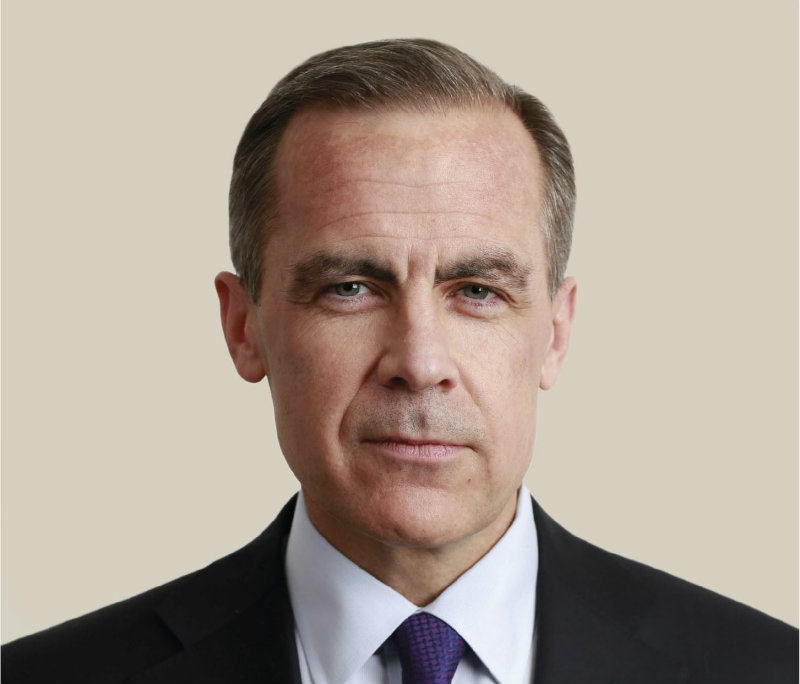

Closing remarks by Mr Mark Carney, Governor of the Bank of England and Chairman of the Financial Stability Board, to the Bank of England Open Forum, London, 11 November 2015.

Let me begin by thanking the Lord Mayor and his team for their gracious hospitality once again. The Guildhall really is a fantastic venue, and I want to take this opportunity, as we approach the end of your term as Lord Mayor, to salute you for the emphasis that you have put on the broader role of finance in society, the broader role of the City of London in the UK economy and in the global economy, and your broader contributions to society. City Giving Day is but one example of that, and we are all very much in your debt for your enormous contribution.

On behalf of my colleagues, I want to thank the Chancellor of the Exchequer and the President of the European Central Bank for their insightful comments. Let me also thank all of the panellists for their well-chosen, provocative, and effective contributions. I am also grateful to the moderators here today, in person or online from across the country, for helping drive our Open Forum.

Most of all, let me thank our steering committee, those 20 people from all walks of life, who put a tremendous amount of time and thought into the sessions. I also want to thank Andy Haldane, our communications staff at the Bank, and our colleagues tasked with making the logistics work - all the way to Edinburgh. Last but certainly not least, let me thank those of you who spent the day with us at Guildhall, those who followed online, and those who participated in our sessions in Birmingham and Edinburgh, Cambridge and Manchester and our many school sessions. Apart from coming up with the words "Open Forum", I've added little to this memorable day, but I have taken away a great deal!

Let me spend a couple of minutes on a few of these takeaways. They are far from comprehensive, and only a starter, because part of the point is that we all need to go back and reflect on what we learned and what we'd like to prioritise.

The first thing that struck me was the almost universal reaffirmation of the importance of markets. Whether it was the vox-pops in the streets of Leeds or Belfast, the feedback from our event in Birmingham, the interventions here in Guildhall, there was a clear recognition of how important these markets are not just to the economy, and not just in an abstract sense, but to people's everyday lives.

At the same time, the level of trust in institutions and market mechanisms is quite low. As Elizabeth Corley highlighted, there is a disconnect between how we in finance - and I include the public sector here - see the sector and how the general public sees the sector.

Interestingly, that disconnect is much less prompted by questions over the health of our banks. Alex Brummer made this same point in terms of a sense of optimism around institutions. That is a good thing because a tremendous amount has been done over the past seven years in order to make banks much stronger. I will not go into all the details, but banks are indeed now beginning to adjust their business models.

I'll add a very clear message on behalf of those of us on the regulatory side to the bankers in the room and those watching from outside: there is no Basel IV. There is no other big wave of capital regulation coming. With the agreement on Total Loss Absorbency Capacity, the last pieces of the puzzle have been put in place.

It is true that we do have to make some adjustments to risk weights; and there will always be things to iron out, but I repeat there is no big other prudential regulatory wave for the banking sector. As Andrew Bailey made clear in one of the break-out sessions I attended, the focus now is about greater certainty and adjusting business models to these new realities. As Andrew noted, given the scale of the regulatory effort, that means that the business models pre-crisis are not necessarily going to be very effective now.

Let me turn back to trust. Why is trust still so low? My sense from the discussions is that trust remains low for two reasons. First, because of misconduct, and secondly, because of a perceived - and, potentially, actual - lack of adequate client focus.

The frequent references to misconduct reinforced in my mind the importance of individual accountability, the focus of the Fair and Effective Markets Review, chaired by Minouche Shafik. It also emphasised the importance of the senior managers' regime coming into effect in the first quarter of next year, and the importance of applying it to true codes and standards in wholesale markets, in a manner that market practitioners understand. The people at coal-face - junior traders, investors and asset managers - must understand what a true market is and their responsibility to act in a way that is consistent with maintaining true markets.

In terms of a perception of a lack of client focus, I took away two gaps that were raised. The first is a financing gap, which I felt came out during the first panel, and which some economic historians in the room compared to the 'Macmillan gap' - the distance between finance and industry being too great. People talk today about an excess of savings not finding a home. In this country, it is felt most in terms of SME and mid-cap finance.

Many were struck by the potential ability of financial technology - fintech - to help bridge this financing gap, but I would emphasise that there was also bit of a caution, as I believe Reverend Giles Fraser noted in the last panel. We should not get too far ahead of ourselves, but look to further evidence that it can bridge the gap. I think the Chancellor is absolutely right that fintech has potential both in terms of expertise in finance and capability in technology. If these can be married effectively, we have an opportunity.

There were a few specific examples that were mentioned that I would just like to reinforce.

First, and as Alex Brummer very rightly emphasised, the opportunities that come from big data and a greater open architecture that is already there. As our Chief Operating Officer Charlotte Hogg would note, the Bank of England is one of the biggest repositories of big data. There is always a question about to what extent that can be leveraged more broadly into the system, and though it is still early days, the Bank may want to consider taking this on as a challenge.

Jon Cunliffe raised a separate and important issue with receivables finance, where fintech could make a real difference. Following the crisis, payment terms for companies increased to 120 days and have not come back. We know there are effective fintech solutions to this which leverage off the credit of the payer. In such circumstances, and more broadly where fintech moves further into more traditional banking areas such as peer to peer and other lending, the Bank recognises that we need to think about and take forward a proportionate, activity-based regulatory response.

Let me turn to the second gap in relation to a lack of client focus: an engagement gap, if I can put it that way. This manifests itself in a number of ways, as noted during the many insightful interventions during our panel sessions. Perhaps Julia Black put it best when she described the dangers of groups of professionals talking just amongst themselves.

This has been part of the issue with financial reform - a sense that reform was a pre-packaged process built on discussions between regulators, banks, and investors, with sympathetic academics adding in their words of support.

Part of the reason for our broader discussions today is to ensure we move out of this state of affairs. And of course, once we bring in other perspectives, it changes our own perspective and underscores just how hermetically sealed the industry in its broad sense can be. Let me say a couple of words on this.

It should be recognized that the industry has made tremendous strides to address a number of issues. An issue touched on earlier in the day was reporting and accounting, and one of the things the industry has done is to come up with something called the Enhanced Disclosure Task Force. The Taskforce proposed a set of recommendations for banks to develop high-quality, transparent disclosures that clearly communicate banks' business models and the key risks that arise from them, so that people who supply capital to the banks can follow how they make money, how they think about managing risk, and make judgments on the basis of that.

The important point was that this was industry-led, and co-chaired by a London-based bank. There was some input from the authorities, but the industry led the initiative, and it's a model we may use in other areas of finance.

I mentioned Total Loss Absorbing Capacity earlier - I won't use the acronym! I'm aware the full name doesn't necessarily make it any more intelligible, but this is basically another layer of capital, and the ability to absorb losses in the event that a firm fails. It is more cost effective - so the cost is not passed on to borrowers. And the technology behind this was developed by the private sector, with the authorities contributing to ensure it could work effectively and on a global basis. But it was the industry, once again, that came up with the solution.

Further innovations are needed if the sector is to come to terms with the new business models that Andrew Bailey and others have mentioned today. For example, innovations in the way banks are organised that are consistent with orderly resolutions.

Separately, and as noted in a number of panels today, asset managers also need to innovate to adapt to the new realities of market liquidity. The increase in the scale of the asset management sector since the crisis has been notable, as has been the emergence of investment funds that offer daily liquidity while investing in securities that only appear liquid. The Bank, the Financial Conduct Authority and the Financial Stability Board are keenly aware of these risks, and we are working to resolve them in an orderly manner.

The area of market liquidity is one place where there may be duplicative regulations and scope for adjustment. Market participants should rest assured we have made adjustments in the past where we have gotten things wrong. We adjusted the liquidity coverage ratio. President Draghi noted the joint work between the Bank and the European Central Bank to change securitisation - an example of fixing something we had not gotten exactly right. We will continue to adjust our market operations.

Let me move towards the conclusion of my conclusion.

The point about reform and review being a continual effort came through in spades. David Kynaston noted that there have been four big bursts of reform in the last 150 years. This one does not need to end - not because we are due Basel IV, or another raft of reforms, but because we will continually adjust as the industry itself innovates. Adjustments will be based on improved engagement with the industry about what's necessary and conversations with a much wider range of people.

Buried in your iPads, under the financial regulation section, is a list of all the current work streams of the FPC, FSB, BCBS, EC, CMU, et cetera - it's all in there. Of course, there are very few people who know what all those acronyms are and what they mean - and shame on them if they do!

This reinforces the point about comprehension, one of the most important takeaways from today. As Jon Cunliffe noted just a short while ago, rather than burying people in acronyms, the responsibility of the official sector is to explain what's going on, why certain things are being done, and what else is necessary. In other words, as a senior banker once told me early on in my career in the private sector, "If it doesn't make sense, it doesn't make sense". I asked him to repeat it because it didn't make sense to me at first.

If someone in finance explains something and it doesn't make sense, and if when they repeat it still doesn't make sense, it's very likely that they don't understand it themselves, which is quite often the case, or that, actually, it doesn't add up.

And that is a good challenge for us at the Bank as well as the broader official community when explaining what's happening and how the system works. Lack of understanding leads to disengagement, which in turn leads to mistrust.

Let me conclude by thanking the huge range of people across the country who really did engage, who did spend the time here with us today. The long-term reward of course, is a more resilient financial system that better serves the needs of society. In the short-term, I hope you will join us for a quick drink in the Crypt of this fantastic building. For those of you in Edinburgh, Alex Brummer would be happy to stump up. And for those of you at home, I hope you will join us in spirit with a drink at your local pub - put it on the Bank of England as a form of quantitative easing.

Source: Bank of England website