Financial Stability Report 2015 (National Bank of Romania publication):

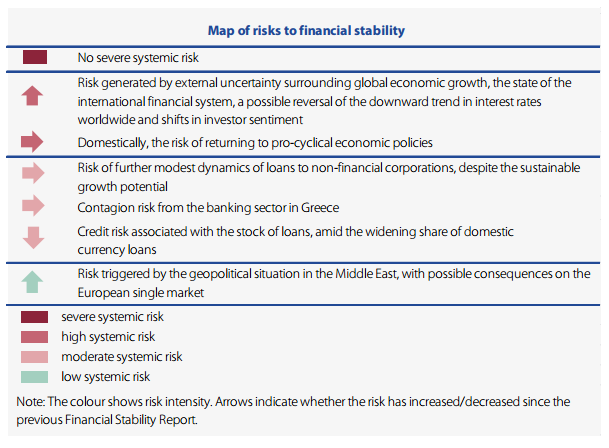

Financial stability has remained solid since the release of the previous Report (September 2014).

The National Bank of Romania fulfilled the macroprudential

objectives within its scope of activity. Financial stability is a public good that may be safeguarded by coordinating macroeconomic policies and cooperating with the other macroprudential authorities.

Both cyclical and structural risks have remained manageable.

The international economic and financial environment continues to be characterised by elevated volatility, but the local banking sector has got the resources to withstand potential adverse developments.

Domestically, preserving macroeconomic equilibria, especially on the fiscal front, is of the essence for financial stability.

With a view to strengthening system resilience to possible adverse developments and aligning with the European regulatory framework requirements, new macroprudential tools are to be implemented in the period ahead.

On the external front, the European Central Bank launched a large-scale quantitative easing programme to prevent deflation risk in the euro area – at a time when the quantitative easing cycle in the US was losing momentum.

This asynchrony of monetary policy in the euro area and that in the US, driven also by the difference between business cycles, fuels global uncertainty and may cause heightened capital flow volatility in emerging economies.

Low interest rates:

(i) may create distortions through the lending channel, as they deepen the debt trap for both households and companies;

(ii) may lead to public finance imbalances via temporary low-cost financing of wider deficits;

(iii) reduce the incentive for structural reforms in the economy;

(iv) may lead to misallocation of resources between economic sectors;

(v) foster investment in higher-yielding, yet riskier and less liquid assets – and hence increase the role of the shadow banking sector, which is less regulated and supervised;

(vi) underestimate credit risk; and

(vii) may diminish monetary policy effectiveness after testing the zero bound.

The persistence of too low interest rates for too long induces the risk of their abrupt reversal.

Against this backdrop, the domestic macroeconomic policy mix should remain prudent and promote sound economic growth, along with keeping the fiscal deficit in line with the Medium Term Objective (MTO) of fiscal policy.

The domestic macroeconomic environment improved on the back of the following developments:

(i) economic growth supported the fast narrowing of the negative output gap, which is foreseen to close in the course of 2016;

(ii) the end of 2014 saw the achievement of the MTO, i.e. a structural deficit of 1 percent of GDP;

(iii) households’ purchasing power increased as the inflation rate slipped into negative territory and their income moved higher;

(iv) the monetary policy rate touched an all-time low;

(v) the current account deficit consolidated at around 1 percent of GDP, amid more competitive exports; and

(vi) the cost of public debt financing stayed on a

downward trend.

However, these developments are not risk-free, as:

(i) economic growth started to be mostly consumption-driven, while potential GDP is further depressed by weak transport infrastructure, the insufficiently fast pace of EU fund absorption and the non-financial corporations’ payment delinquency;

(ii) budget adjustment was accomplished largely via spending cuts, amid failure to carry through the scheduled

investment, and now the risk of a trend reversal of the last five years’ budget adjustment is looming because of pro-cyclical economic policies;

(iii) curbing of inflation was primarily ascribed to lower fuel prices on international markets and to the cut in the VAT rate on food items domestically, which mask however the persistence of inflationary pressures that will become manifest once the base effect has faded out;

(iv) monetary policy should take account of the macroeconomic policy mix;

(v) the current account deficit may start widening again, on the back of higher imports driven by rising consumer spending; and

(vi) investor sentiment might change following adverse developments locally or externally, which may swiftly push financing costs higher, while restraining the possibility for the domestic banking sector to raise its sovereign debt exposure.

The local banking sector supported the favourable developments in the economy via:

(i) substantial rise in leu-denominated loans, particularly mortgage loans to households, amid lower lending rates;

(ii) decline in household indebtedness and in debt servicing cost for leu-denominated variable-rate loans;

(iii) improvement in asset quality through a significant reduction in the non-performing loan rate, which is likely

to facilitate lending recovery;

(iv) mitigation of currency risk through a change in the loan stock composition, i.e. a widening share of leu-denominated loans;

(v) narrowing of the spread between lending and deposit rates; and

(vi) further consolidation of bank prudential indicators (solvency and liquidity ratios), which helped insulate the

banking sector against the contagion risk induced by foreign market uncertainty.

On the other hand, an impact on banking sector dynamics had also the following factors:

(i) the still weak lending to non-financial corporations, despite their important borrowing potential;

(ii) low-income households still report an elevated level of

indebtedness and remain vulnerable to interest rate shocks;

(iii) the banks’ balance sheet clean-up is still under way, contributing to their lower profitability;

(iv) foreign currency loans still prevail and currency risk materialised in 2015 for borrowers in Swiss francs and US dollars following the strengthening of these currencies versus the euro, without however triggering systemic risk;

(v) the interest rate margin can be narrowed further in order to near the EU average; and

(vi) close monitoring and a prudent approach in relation to local banks with Greek capital are further warranted.

The 2015 Financial Stability Report is organised as follows: Chapter 1 discusses the international and domestic economic and financial environment.

Chapter 2 deals with the real sector, i.e. non-financial corporations and households.

Chapter 3 looks at the financial sector, and Chapter 4 focuses on the financial sector infrastructure. Chapter 5

provides an in-depth overview of financial stability as a public good, describes the European regulatory framework and how macroprudential policies are implemented

in Romania.

Topical issues are separately addressed throughout the Report, such as the sovereign debt crisis, the state of CHF-denominated loans, the developments in the “First Home” programme, the role played by the National Committee for

Macroprudential Supervision.

The 2015 Financial Stability Report also includes a special feature on Romania’s public debt sustainability seen from the perspective of financial stability.

The special feature provides answers as to why the public debt increased and how the money was spent, and assesses public debt sustainability.

The analysis finds that Romania’s public debt is sustainable at present in terms of size, but there is a risk of going beyond a critical threshold in the case of adverse economic conditions, an interest rate shock or budget slippages.

Since 2011, refinancing risk has been decreasing steadily, financing costs have contracted substantially and the investor base has diversified.

Nevertheless, public debt has shown reliance on the local banking sector, which has also had some benefits in terms of mitigating contagion risk and boosting liquidity, but the potential to further tap this financing source has largely been exhausted.