National Bank of Romania - Monetary indicators - July 2015 (press release):

At end-July 2015, broad money (M3) amounted to RON 260,155.8 million, declining 0.3 percent (down 0.1 percent in real terms) month on month. In year-on-year comparison, broad money rose 8.1 percent (9.9 percent in real terms).

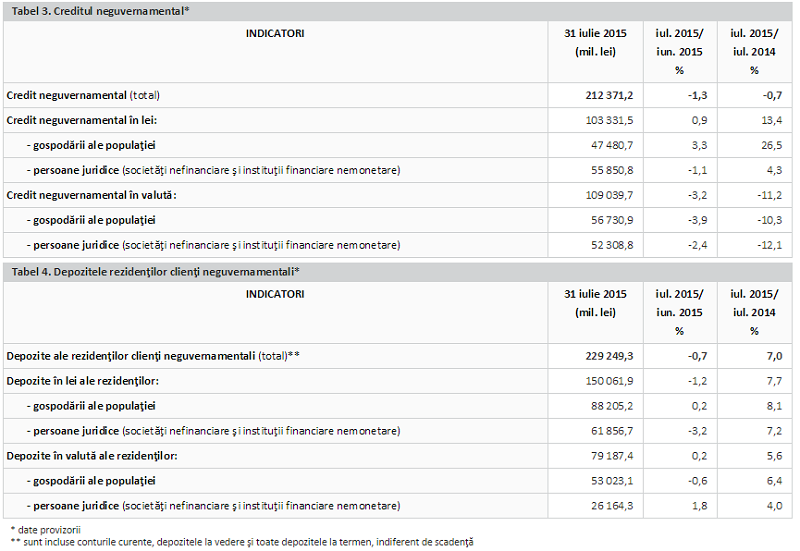

At end-July 2015, non-government loans granted by credit institutions declined by 1.3 percent (down 1.1 percent in real terms) from June 2015 to RON 212,371.2 million. RON-denominated loans increased by 0.9 percent (1.1 percent in real terms), whereas foreign currency-denominated loans fell by 3.2 percent when expressed in RON and by 1.8 percent when expressed in EUR. At end-July 2015, non-government loans decreased by 0.7 percent (up 1.0 percent in real terms) year on year, on the back of the 13.4 percent increase in RON-denominated loans (15.4 percent in real terms) and the 11.2 percent decline in foreign currency-denominated loans expressed in RON (when expressed in EUR, forex loans dropped 10.9 percent).

Government credit (1) contracted by 2.6 percent month on month to RON 85,491.7 million. At end- July 2015, government credit increased by 8.1 percent (10.0 percent in real terms) from the same year-ago period.

Deposits of non-government resident customers went down 0.7 percent month on month to RON 229,249.3 million in July 2015.

RON-denominated household deposits added 0.2 percent to RON 88,205.2 million. At end-July 2015, household deposits in domestic currency rose by 8.1 percent (9.9 percent in real terms) against end-July 2014.

RON-denominated corporate deposits (non-financial corporations and non-monetary financial institutions) decreased by 3.2 percent to RON 61,856.7 million. At end-July 2015, RON-denominated corporate deposits climbed by 7.2 percent (9.0 percent in real terms) year on year.

Forex-denominated deposits of resident households and corporates (non-financial corporations and non-monetary financial institutions) went up 0.2 percent to RON 79,187.4 million when expressed in domestic currency (when expressed in EUR, forex deposits increased by 1.7 percent to EUR 17,968.6 million). In year-on-year comparison, residents’ forex deposits expressed in RON advanced 5.6 percent (when expressed in EUR, residents’ forex deposits rose by 5.9 percent); household forex deposits grew by 6.4 percent when expressed in domestic currency (when expressed in EUR, household forex deposits expanded by 6.7 percent) and forex deposits of legal entities (non-financial corporations and non-monetary financial institutions) went up 4.0 percent when expressed in RON (when expressed in EUR, forex deposits of resident legal entities stood 4.3 percent higher).

Note: In the monetary balance sheets of monetary financial institutions, the accrued interest receivable/payable related to financial assets and liabilities is recorded under remaining assets/remaining liabilities.

(1) includes credit to general government (central government, local government and social security funds) in amount of RON 9,885.8 million and debt securities issued by these institutional sectors running at RON 75,605.9 million (outstanding as at end-July 2015).

NBR press release