The Balance Sheet Review and Stress Test show that a number of Romanian insurance undertakings need to take swift action to strengthen their financial and solvency positions (press release):

The Balance Sheet Review and Stress Test, which was the first comprehensive assessment of the insurance sector performed in an EU Member State, was conducted in close cooperation between Romanian Financial Supervision Authority (ASF), European Commission and the European Insurance and Occupational Pensions Authority (EIOPA) with the support of five international auditing firms and one international consultancy firm. The exercise aimed to enhance both consumer protection and confidence in the Romanian insurance sector through an independent assessment based on the financial accounts of 30 June 2014.

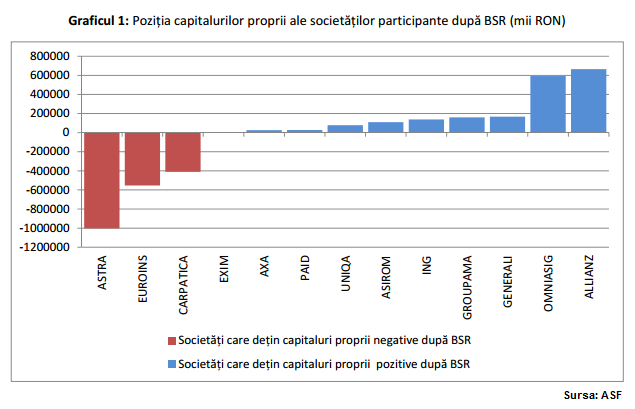

The results of this exercise covering 13 Romanian insurance undertakings representing more than 80% of the Romanian insurance market were published on the ASF website today.

The Balance Sheet Review found an aggregated capital shortfall under the current prudential framework (Solvency I) of RON 1.6 billion (about EUR 356 million), concentrated in four undertakings. In line with the agreed follow-up actions for this exercise published on the ASF website on 18 February 2015, two of the four undertakings with capital shortfalls will have to submit an action plan to the ASF by 4 August 2015.

These action plans must set out the measures they will take by 15 October 2015 to restore compliance with the solvency margin requirements under Romanian Law 32/2000. Two undertakings are already in a financial recovery procedure. They must consider the additional shortcomings and communicate to the ASF within twenty calendar days after the closure of the financial recovery procedure how those shortcomings were addressed.

When analysed under the Solvency II framework, a regime that will be in place from the beginning of 2016, the results indicate that the Romanian insurance sector would not be sufficiently capitalised. Four undertakings have a Solvency Capital Requirement ratio above 100% while eight undertakings have the Minimum Capital Requirement ratio above 100%. Some of the participating undertakings have already implemented a number of corrective measures, which will be considered when the ASF receives the action plans.

The comprehensive assessment also included a stress test which aimed to measure the resilience of insurance undertakings under stress scenarios.

The stress test was conducted on the basis of two economic and financial market scenarios as well as two insurance scenarios involving earthquakes and floods. The earthquake and flood scenarios were the most severe and revealed that only one and three undertakings, respectively, would meet the Solvency Capital Requirement ratio.

The economic and financial market stress scenarios were less severe with four undertakings meeting the Solvency Capital Requirement ratio. Insurance undertakings must prepare action plans by 4 August 2015 setting out the measures that they will take to ensure compliance with Solvency II by 1 January 2016.

The report on the results of the Romanian Balance Sheet Review and Stress Test can be found on the website of the ASF.