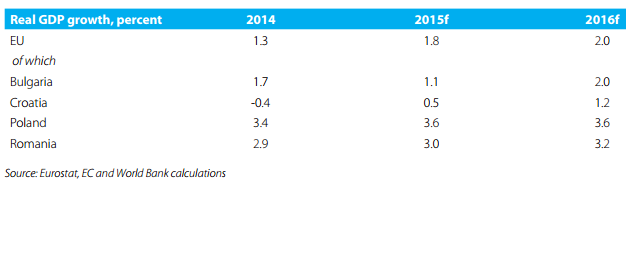

The economic outlook for Romania is positive, but risks remain. Real GDP growth is projected at around 3 percent, supported by further recovery in domestic demand, according to a World Bank report.

Private consumption will likely remain the main driver of growth on the back of an increase in real disposable income and positive labor market developments. An anticipated pick-up in the absorption of EU funds would support a recovery in investment.

Current account deficit is expected to widen a little, driven by a rise in imports, but it would still remain at around 1 percent of GDP.

For 2015, structural fiscal deficit will be around 1.0 percent of GDP (1.8 percent on a cash basis), bringing Romania in line with its Medium Term Objective (MTO) under the EU Fiscal Compact.

However, in late March the Government proposed a package of tax reductions—in VAT, excises, construction tax, dividends, etc.— to be implemented from 2016. In the absence of compensatory measures, the adoption of the package would have an adverse impact on the fiscal deficit.

With average inflation expected to remain around zero in the first half of 2015, the NBR may also be prompted to ease its policy rate in the coming months.

However, the positive macroeconomic situation is partly overshadowed by delays in implementing structural reforms, in particular the calendar for the liberalization of gas prices for households and on the restructuring of the state-controlled energy generation sector.

Renewed policy attention is needed to improve the efficiency of public spending, in particular in the area of public investment.