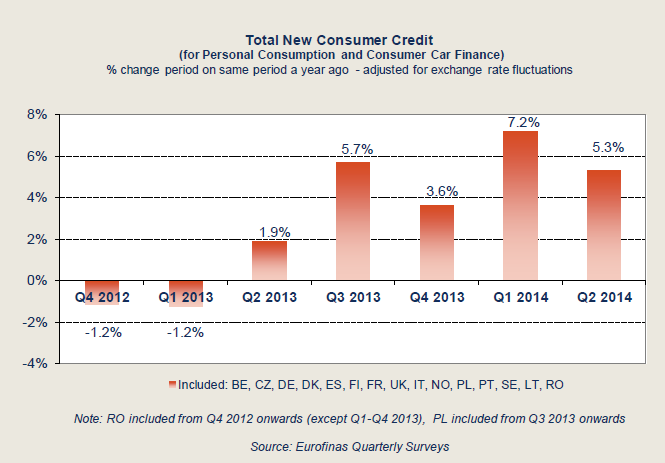

ALB is announcing the results of Eurofinas, the representative body of the European consumer credit industry, for the second quarter of 2014 (Q2 2014)

The outlook of the total new consumer credit granted by the firms represented through the membership of the Federation, grew by 5.3% compared to Q2 2013. This upturn was the result of the vast majority of national markets witnessing growth during this period.

Looking at product types, total consumer credit for personal consumption and consumer car finance

(for new and used cars taken together) increased by 3.5% and 9.4%, respectively, in new volumes granted in Q2 2014 compared to Q2 2013, pursuing an upward trend commenced a year ago.

Commenting on the latest Eurofinas survey results, J. Bucyte, Adviser in Statistics and Economic Affairs at Eurofinas said, “After a solid first quarter that saw an overall increase in European consumer lending and improved confidence, new credit granted continued to hold steady in Q2 2014. For the latest survey, most Eurofinas members reported quite good, if not double digit, growth. However, this growth should be considered with caution as some markets, such as in Southern Europe, have rebounded from very low levels reached in the past years. Nevertheless, in light of the expected increase of demand for consumer credit and sustained economic recovery, conditions appear favorable for this trend to continue into the early fall.”

Olivier Floris, ALB Vice-President and General Manager of Cetelem IFN said: "Within the slow economic recovery in Europe, the published results show that non-bank financial sector, through the consumer credit supports the consumer in a direct and active way in order to accomplish their personal projects. Equally, the Romania market's major players confirm this positive trend. "

For more details or information regarding Eurofinas report, please access the web page: www.eurofinas.org