ECB press release:

- 3.8% drop in total number of monetary financial institutions (MFIs) [1] in the euro area to 6,790.

- Declines in 14 out of 18 euro area countries.

- 8,746 MFIs in the European Union (EU) as a whole, a net decrease of 330 units (-3.6%).

Number of MFIs

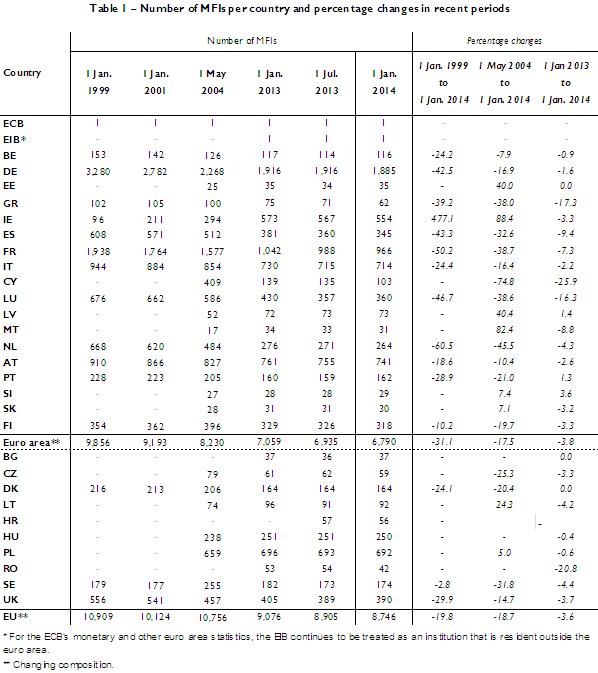

On 1 January 2014 there were 6,790 MFIs resident in the euro area, compared with 7,059 on 1 January 2013. In relative terms, the decrease was particularly pronounced in Cyprus (-26%), Greece (-17%), Luxembourg (-16%), Spain (-9%), Malta (-9%) and France (-7%). In absolute terms, Luxembourg (-70), France (-76), Spain and Cyprus (-36) were the main contributors to the net decrease of 269 units in the euro area.

Since 2011 a substantial decrease in the number of money market funds (an MFI sub-sector) has been recorded in the euro area (-658 over three years), partly on account of their new statistical definition, which has been adjusted towards supervisory standards. In addition, the contraction in this sub-sector continued during 2013, most prominently in Luxembourg (-77) and France (-65).

Despite the enlargement of the euro area with the accession of Greece (2001), Slovenia (2007), Cyprus and Malta (both 2008), Slovakia (2009), Estonia (2011) and Latvia (2013), the number of MFIs in the euro area has decreased by 31% – or 3,066 institutions – since 1 January 1999. On 1 January 2014 Germany and France accounted for 42% of all euro area MFIs, approximately the same share as recorded on 1 January 2013.

On 1 January 2014 there were 8,746 MFIs resident in the EU, a net decrease of 330 units (‑3.6%) since 1 January 2013. Compared with the situation on 1 January 1999, when there were 10,909 MFIs in the EU, there has been a net decrease of 2,163 units (-20%), despite the (net) addition of 1,608 MFIs on 1 May 2004, when ten new Member States acceded, a further 72 MFIs on 1 January 2007, when Bulgaria and Romania joined the EU, and the addition of 57 Croatian MFIs on 1 July 2013.

Structure of the MFI population

The vast majority of euro area MFIs are credit institutions (i.e. commercial banks, savings banks, post office banks, credit unions, etc.), which accounted for 87% of MFIs (5,909 units) on 1 January 2014, while money market funds accounted for 12% (816 units). Central banks (19 units including the ECB) and other institutions (46 units) together accounted for only 1% of the total number of euro area MFIs.

In the EU as a whole, credit institutions accounted for 88.3% of MFIs on 1 January 2014, while money market funds accounted for 10.8% (see Chart 2 below).

Country breakdown on 1 January 2014

In the euro area, Germany and France accounted for 42% of all MFIs. Austria, Italy and Ireland accounted for a further 30%. 78% of the sub-category of money market funds are concentrated in France, Luxembourg and Ireland. Over the past 15 years (1999-2013), one noteworthy development in national MFI sectors over the period as a whole is a significant increase of 458 units in Ireland. [2] At the same time there were relatively large declines in the number of MFIs in the Netherlands (61%), France (50%), Luxembourg (47%) and Spain (43%) and lesser declines in Portugal (29%), Italy and Belgium (24%) (see Table 1 below).

Among the non-euro area EU Member States, Poland had the largest number of MFIs (692), representing 8% of MFIs in the EU, or 35% of MFIs in the non-euro area EU Member States. The other main contributors among non-euro area EU Member States were the United Kingdom (20%), Hungary (13%), Sweden (9%) and Denmark (8%). Between the beginning of 1999 and 1 January 2014, there were considerable reductions in the number of MFIs in the United Kingdom and Denmark, by 30% and 24% respectively.

Foreign branches

On 1 January 2014 there were 645 branches of non-domestic credit institutions resident in the euro area. These branches accounted for 11% of all euro area credit institutions. 108 of these branches (17%) were located in Germany. Belgium, Slovakia and Greece had the largest number of foreign branches as a proportion of the total number of credit institutions, at 62%, 54%, and 48% respectively. The head offices of the majority of the foreign branches in euro area countries were located either in another euro area country (63%) or in the United Kingdom (15%).

In comparison with the situation as at end-2012, the number of branches of non-domestic credit institutions in the euro area had thus increased slightly in 2013 by 4%.

On 1 January 2014 there were 249 branches of foreign credit institutions resident in non-euro area EU Member States. Of these, by far the largest proportion (55%) was located in the United Kingdom. The head offices of the majority of the foreign branches in non-euro area EU Member States were located either in euro area countries (53%) or in other EU Member States (16%).